lhdn tax rate 2019

Based on your chargeable income for 2021 we can calculate how much tax you will be paying for last years assessment. Borang PCB TP2 2010.

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Lhdn Tax Rate 2019 - Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt.

. If youre a law-abiding citizen and in the midst of filing your LHDN taxes for 2019s assessment this guide is more important than ever. So the more taxable income you earn the higher the tax youll be paying. New penalty rates for Late filing of Income Tax Returns in Malaysia effective from 1 October 2019.

For the period of 112022 and thereafter disposal in the sixth year after the date of acquisition of the chargeable asset is changed back to nil. Borang PCB TP1 2010. Pengiraan RM Kadar CukaiRM 0 - 5000.

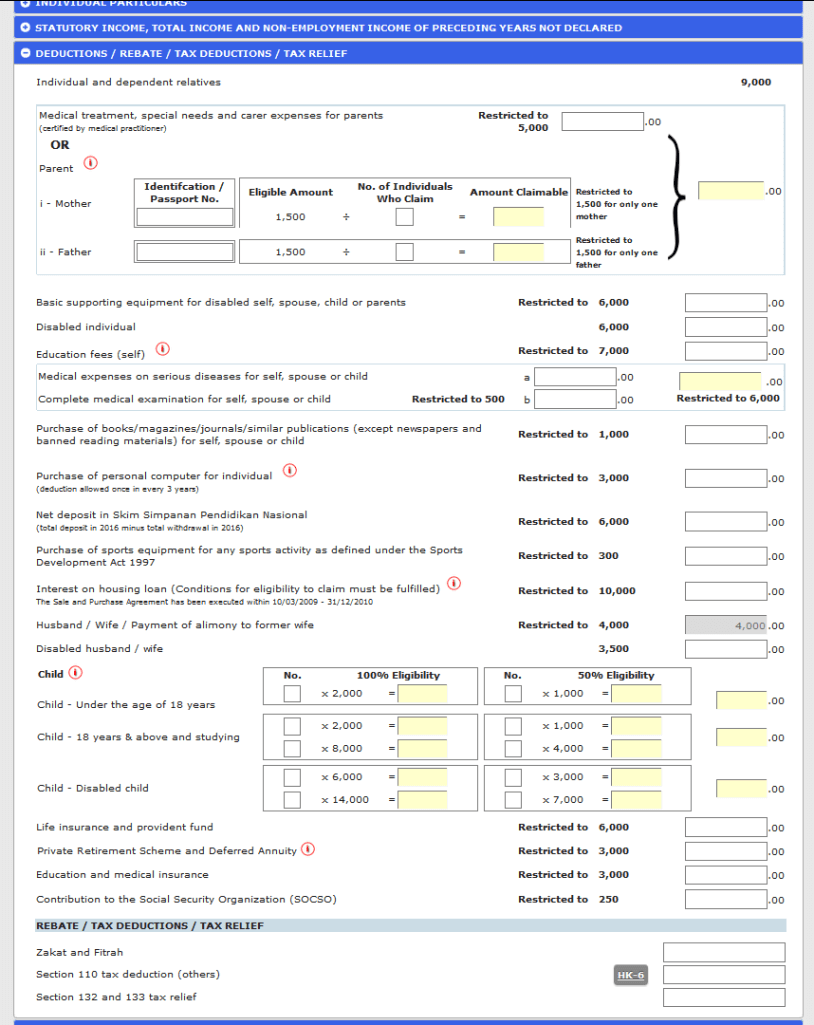

PENSIONABLE PUBLIC SERVANT CATEGORY Life insurance premium ii OTHER THAN PENSIONABLE PUBLIC SERVANT CATEGORY Life insurance premium Restricted to RM3000 Contribution to EPF approved scheme Restricted to RM4000 INDIVIDUAL dependent relatives RM9000 01 RM5000 Medical treatment special. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Banjaran Pendapatan Bercukai Pengiraan RM Kadar CukaiRM 0 - 5000.

The Simple PCB calculator takes into account of RM2000 special tax relief limit that capped at income RM8000mth. The article is intended to provide a general guide to the subject matter and should not be regarded as a basis for ascertaining the liability to. Introduced optional RM2000 special tax relief switch to comform to LHDNs standard.

Tax Rate of Company. Lembaga Hasil Dalam Negeri LHDN Malaysia. This article is based on the Operational Guidelines No52019 issued on 16 October 2019 by LHDN.

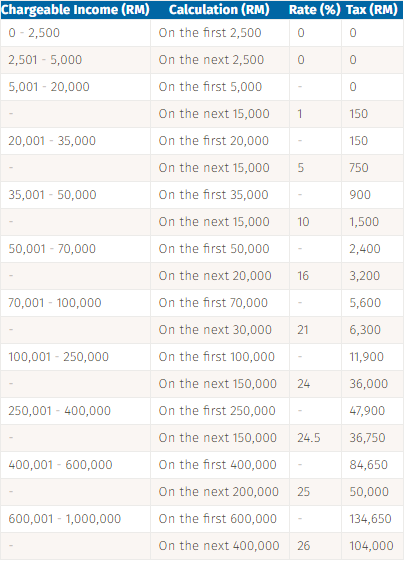

Your tax rate is calculated based on your taxable income. Company with paid up capital not more than RM25 million. Jadual Average Lending Rate Bank Negara Malaysia Seksyen 140B.

TAX RELIEF for resident individual i. Coming back to the tax exemptions and reliefs these are all the ones that were announced by the government during the 2022 Budget speech. 102019 INLAND REVENUE BOARD OF MALAYSIA Date of Publication.

Non-resident company branch 24. Income Tax Rates and Thresholds Annual Tax Rate. Income tax rates 2022 Malaysia.

Heres what you need to know about getting a tax appraisal. Lhdn Tax Rate 2019. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others.

Semoga perkongsian maklumat berkenaan kadar cukai pendapatan individu pemastautin bagi tahun taksiran 2021 ini berguna. Per LHDNs website these are the tax rates for the 2021 tax year. On first RM500000 chargeable income 17.

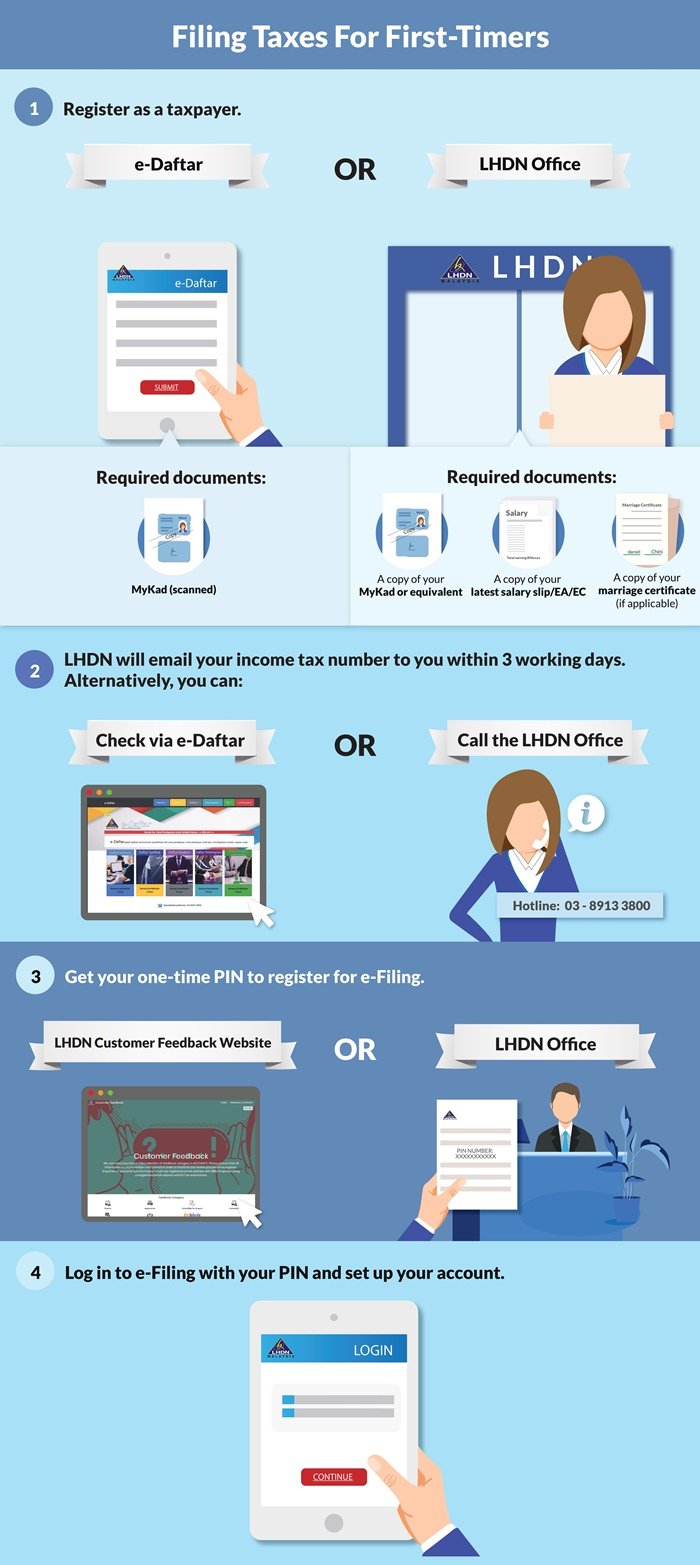

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 510300 and higher for single filers and 612350 and higher for married couples filing jointly. Company Taxpayer Responsibilities. The deadline for filing income tax in Malaysia is 30 April 2019 for manual filing and 15 May 2019 via e-Filing.

Starting from 0 the tax rate in Malaysia goes up to 30 for the highest income band. It is the tax which is imposed on the gains when you dispose the property in Malaysia. Kalkulator PCB Lembaga Hasil Dalam Negeri.

Income Tax Brackets and Rates. Lembaga Hasil Dalam Negeri Malaysia tidak bertanggungjawab terhadap sebarang kehilangan atau kerosakan yang dialami kerana. According to lembaga hasil dalam negeri lhdn the move is meant to facilitate the submission of tax returns affe.

A SME is defined as a company resident in Malaysia which has a paid-up capital of ordinary shares of RM25. Remember the deadline to e-file your IRB. Borang PCB TP3 2010.

Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file. Malaysia Non-Residents Income Tax Tables in 2019. Resident Individual Tax Rates for Assessment Year 2018-2019.

Below are the Individual Personal income tax rates for the Year of Assessment 2021 provided by the The Inland Revenue Board IRB Lembaga Hasil Dalam Negeri LHDN Malaysia. Tahun Taksiran 2018-2019 Banjaran Pendapatan Bercukai. While RPGT rate for other categories remained unchanged.

WITHHOLDING TAX ON SPECIAL CLASSESS OF INCOME Public Ruling No. Yes youve come to the right place tax relief for your income taxes. Tax Rate of Company.

EPF Rate variation introduced. Here are the progressive income tax rates for Year of Assessment 2021. You can refer to their official website for your contribution table and rates.

And subject to Lembaga Hasil Dalam NegeriLHDN approval in order to get the Nett Chargeable Gain. Latest 2019 RPGT Rates in Malaysia. Payment for child care fees to a registered child care centre kindergarten for a child aged 6 years and below.

In 2019 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1. Chargeable Income Calculations RM Rate TaxRM 0 - 5000. Nota Penerangan Jadual PCB 2013.

Nota Penerangan Jadual PCB 2010. Malaysian Company Foreigner. Nota Penerangan Jadual PCB 2012.

From the period of 112019 until 31122021 disposal in the sixth year after the date of acquisition of the chargeable asset is 5. October 15 2021 Post a Comment This is the amount you pay to the state government based on the income you make as opposed to federal income tax that goes to the federal government. 10 December 2019 Page 1 of 42 1.

On subsequent chargeable income 24. Objective The objective of this Public Ruling PR is to explain - a special classes of income that are chargeable to tax under section 4A of the Income Tax Act 1967 ITA. Resetting number of children to 0 upon changing from married to single status.

Purchase of breastfeeding equipment for own use for a child aged 2 years and below Deduction allowed once in every 2 years of assessment 1000 Restricted 13. You can file your taxes on ezHASiL on the LHDN website. Now that youre up to speed on whether youre eligible for taxes and how the tax rates work lets get down to the business of actually filing your taxes.

Kadar Cukai Individu Untuk Tahun Taksiran 2018-2019. Resident company with paid-up capital above RM25 million at the beginning of the basis period 24.

How To Submit Income Tax 2019 Through E Filing Lhdn Otosection

The Gobear Complete Guide To Lhdn Income Tax Reliefs Otosection

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Cukai Pendapatan How To File Income Tax In Malaysia

Budget 2013 Personal Tax Rate Reduced By 1

List Of Lhdn S Income Tax Relief For E Filing 2021 Ya 2020 Otosection

Ctos Lhdn E Filing Guide For Clueless Employees Otosection

Lhdn Irb Personal Income Tax Rebate 2022

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Em Han Associates Posts Facebook

Malaysia Personal Income Tax Guide 2019 Ya 2018 Ringgitplus Com

What Happens When Malaysians Don T File Their Taxes Update

Paid For Covid 19 Rt Pcr And Self Test Kits In 2021 You Can Claim Tax Relief Up To Rm1 000

The Gobear Complete Guide To Lhdn Income Tax Reliefs Otosection

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Ctos Lhdn E Filing Guide For Clueless Employees

Download Kwsp Income Tax Relief 2019 Gif Kwspblogs

Malaysia Personal Income Tax Guide 2021 Ya 2020

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

No comments for "lhdn tax rate 2019"

Post a Comment